Critical raw materials

25% of the EU's annual consumption must come from internal recycling

The world risks running out of critical raw materials by 2050

The new challenge that the European Union is preparing to face with Critical Raw Materials can only be overcome through the good practice of circular economy with correct zero-impact management of different types of waste, from electronic products to batteries, from packaging to textiles and muds.

HPP comes to the aid of new government requests and recovers Critical Raw Materials.

Critical raw materials are all those mineral materials that are the basis for the production of goods, through certain processes that allow the proposed final product to be transformed and then obtained, and therefore essentially constitute the original raw material and currently used mainly in the so-called energy transition and in current digital technologies.

Since ancient times, some metals such as gold, silver, lead and copper have been considered of "strategic" importance by states, militias or groups. Since the industrial revolution, the quantity and diversity of mineral resources necessary for agriculture, industry and armies has not ceased to grow and even more so since the end of the 20th century, «in close correlation with the quantity of products containing of high technology placed on the market". At the end of the 20th century, the awareness of the finite and unavailable or poorly renewable nature of some resources (minerals, metals, metalloids, radionuclides, etc.), as well as their strategic interest (for the economy and societies) gave rise to prospective methods for evaluating the criticality in the procurement of materials.

Since the seventies of the twentieth century, researchers and economists have tried to integrate the evaluation of mineral resources among the environmental impact indicators in the first studies of life cycle analysis (LCA), ecological footprint and compensatory measures and/or in other forms of environmental assessment, but without actually arriving at a scientific consensus.

In 2008 the European Commission presented the "raw materials" initiative "which sets out a strategy to address the issue of access to raw materials in the European Union".

On 12 May 2011, the International Resource Panel of the United Nations Environment Program (UNEP) published the report Decoupling Natural Resource use and Environmental Impacts from Economic Growth, which analyzes the concept of "decoupling", in the sense of improving the rate of resource productivity faster than the rate of economic growth. The report highlights the need for massive investments in technological, financial and social innovation, to freeze per capita consumption in rich countries and help developing countries identify a sustainable path; Stresses that the world is running out of cheap, high-quality sources of oil, copper and gold and that these require increasing volumes of fossil fuels and fresh water to produce; notes that cities enable economies of scale and more efficient service provision, including water provision, housing, waste management and recycling, energy use and transport.

In the subsequent report of 24 April 2013, the International Resource Panel estimates that the demand for rare metals will rapidly exceed 3 to 9 times the quantities consumed in 2013, that it is urgent and a priority to recycle rare metals (produced in quantities of less than 100,000 t/year) in circulation in the world to save natural resources and energy, but this will not be enough. It is necessary to limit the planned obsolescence of the objects containing them and to recycle all components of computers, mobile phones or other electronic objects found in waste electrical and electronic equipment (WEEE), which implies the search for alternative materials, which are eco-sustainable and that consumers and communities change their behavior in favor of separate waste collection aimed at almost total recycling of metals.

A World Bank report published in 2020 warns that the production of minerals – such as graphite, lithium and cobalt – could increase by almost 500% by 2050, totaling more than 3 billion tonnes to keep global warming below 2°C. increase.

A report from the International Energy Agency (IEA) published in May 2021, alerts States to the explosion in global demand from the energy sector for critical metals caused by the decarbonisation of economies: this demand could be multiplied by 4 if the world will comply with the commitments of the Paris Agreement. Much of this growth will be driven by the needs of electric vehicles and their batteries, followed by those of electricity grids, photovoltaic panels and wind power. The need for lithium could be multiplied by 42 by 2040, that of graphite by 25, that of cobalt by 21 and that of nickel by 19. However, these materials are concentrated in a few countries: three countries extract 50% of the copper in the world : Chile, Peru and China; 60% of the cobalt comes from the Democratic Republic of Congo; China mines 60% of the world's rare earths and controls more than 80% of their refining. According to the IEA, states must find solutions to avoid being dependent on third countries as well as build strategic reserves to avoid any interruption in supply.

In the United States, critical minerals that are at risk of shortage or supply chain disruption are assessed by the United States Geological Survey (USGS) and the National Science and Technology Council (NSTC)

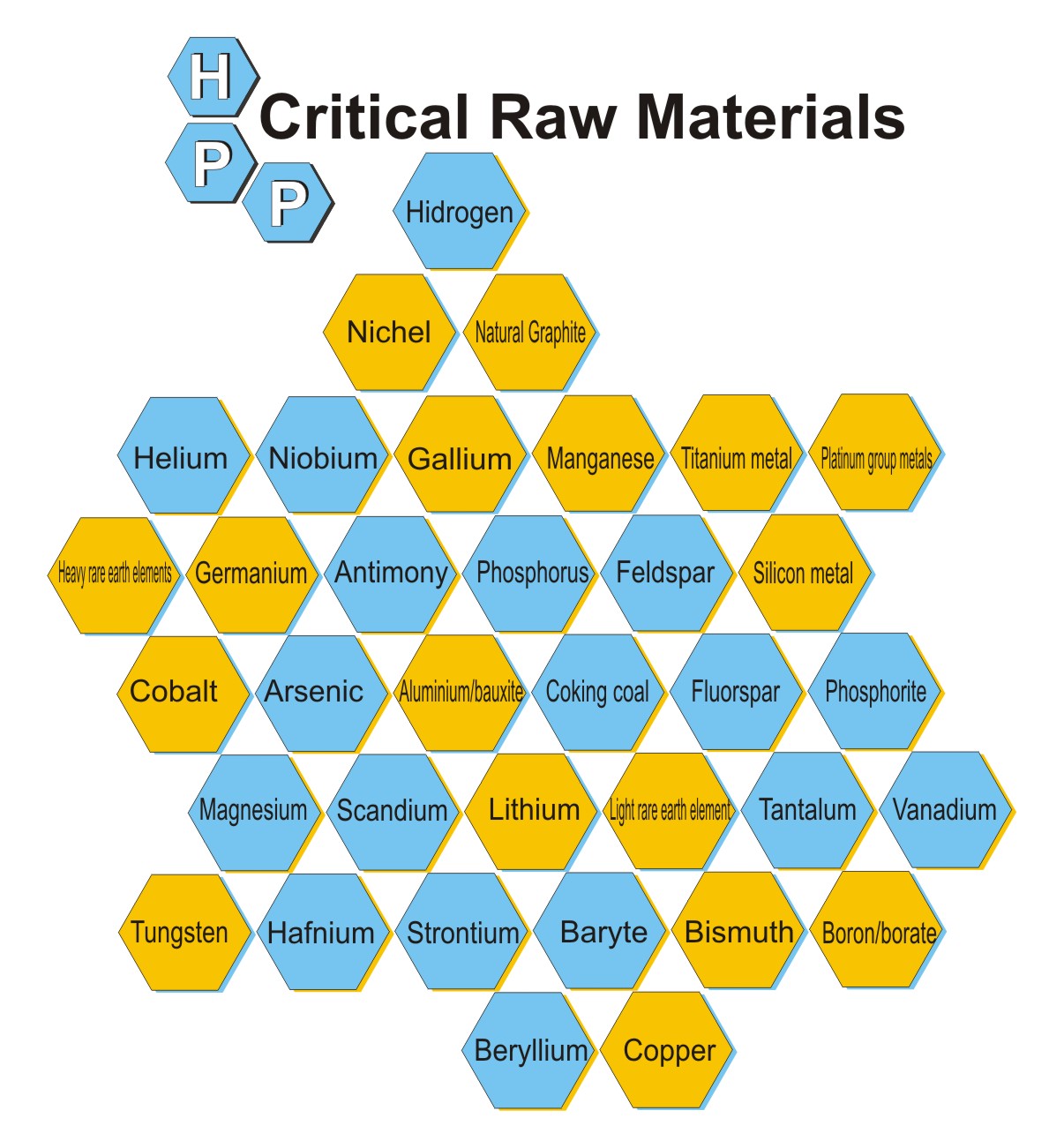

The European Commission, after presenting the "raw materials" initiative in 2008, presented a first list of 14 "essential raw materials" in 2011, updated in 2014 with 20 raw materials, in 2017 with 27 raw materials and in 2020 with 30 raw materials. On 18 March 2024 the Council of the European Union definitively approves the regulation on Critical Raw Materials and the definitive text adopted identifies two lists of 34 critical raw materials of which 17 strategic raw materials are fundamental for the green and digital transitions as well as for defense and space industry.

In the communication of 3 September 2020, the European Commission, after evaluating 83 raw materials, developed a sort of strategy in order to strengthen and better control the supplies of thirty critical raw materials, in particular rare earths, towards a good green revolution and digital. The list included, for example, graphite, lithium and cobalt, used in the manufacture of electric batteries; silicon, an essential component of photovoltaic panels; rare earths used for magnets, semiconductors and electronic components. However, the Commission has estimated that the European Union will need 18 times more lithium and five times more cobalt by 2030 to reach its climate goals.

Since many of these raw materials are present in Europe, the Commission has estimated that the European automotive industry could meet 80% of its needs by 2025.

Material recycling aimed at recovering critical raw materials will be developed

In the event that European resources are insufficient, the Commission will strengthen long-term partnerships, in particular with Canada, Africa and Australia.

On 24 November 2021, the European Parliament approved a resolution on the "European Strategy for Critical Raw Materials", which refers to the strengthening of primary mining activity, in addition to measures of sustainable design, recovery and recycling of materials and diversification of the raw materials used. In particular, the importance of avoiding a relocalization of emissions in medium or low-income countries and of maintaining and developing technical skills in the field of extraction and processing technologies within the Union is highlighted, considering that the standards and European environmental standards are among the most rigorous in the world and that mining activities create thousands of highly skilled jobs.

In the period 30 September - 25 November 2022, the European Commission is calling for contributions on the proposed "European Regulation on Critical Raw Materials".

On 16 March 2023, the European Commission presented a draft Regulation on Critical Raw Materials (Critical Raw Material Act), which presents an updated list of raw materials critical for the entire Union economy, as well as "strategic" raw materials, which are the most crucial for technologies used for green, digital, defense and space applications.

The proposal sets benchmarks along the value chain of strategic raw materials and for the diversification of Union supplies:

at least 10% of the annual Union consumption for extraction,

at least 40% of annual Union consumption destined for processing,

at least 15% of the annual Union consumption for recycling,

no more than 65% of the Union's annual consumption coming from a single third country.

The proposed legislation aims to create safe and resilient supply chains, critical raw material supply chain monitoring and stress testing, take measures to improve the collection of waste rich in critical raw materials and ensure its recycling into secondary critical raw materials, diversify imports and coordinate partnerships with third countries.

In 2024, the European Parliament and the Council of the European Union approved Regulation 2024/1252 of 11 April 2024 "establishing a framework to ensure a secure and sustainable supply of critical raw materials". The Regulation accepts the proposal presented by the European Commission on 16 March 2023 and comes out in the same period as the regulation on the "net zero emissions industry", which aims to increase the production of key carbon-neutral technologies for chains clean energy supply.

On 18 March 2024, the Council of the European Union definitively approves the regulation on critical raw materials and the definitive text adopted identifies two lists of 34 critical materials, 17 of which are strategic, which are fundamental for the green and digital transitions as well as for the defense and space.

The main parameters used to determine the criticality of raw materials for the European Union are:

Economic importance: aims to provide information on the importance of a material for the Union economy in terms of end-use applications and the added value of the corresponding manufacturing sectors classified by the Nomenclature of Economic Activities (NACE rev. 2). The economic importance is corrected by the substitution index (SIEI) relating to the technical and cost performance of substitutes for individual applications.

Supply risk: reflects the risk of a disruption to the Union's supply of the material and is based on the concentration of primary supply of raw material producing countries, considering their governance performance and trade aspects. Depending on the dependence on imports, the two groups of producing countries are proportionately taken into consideration: the global suppliers and the countries from which the Union sources its raw materials. The 'supply risk' is measured at the 'bottleneck' stage of the material (extraction or processing), which presents the highest supply risk to the Union. Replacement and recycling are considered risk reduction measures.

Note the final report on critical raw materials, published in March 2023, which presents the results of the European Commission's fifth technical assessment. The study examines 70 raw materials, including 67 individual materials and three groups of materials (ten heavy rare earths, five light rare earths and five platinum group metals), a total of 87 individual raw materials. The report indicates 51 individual critical raw materials, of which 34 are "strategic" raw materials

| Raw Materials | world's leading manufacturer | perc. | main UE supplier | perc. |

| afnium | France | 49% | France | 76% |

| aluminum | Australia | 28% | Guinea | 63% |

| antimony | China | 56% | Türkiye | 63% |

| arsenic | China | 44% | Belgium | 59% |

| barite | China | 44% | China | 45% |

| beryllium | United States of America | 88% | United States of America | 60% |

| bismut | China | 70% | China | 65% |

| boron | Türkiye | 48% | Türkiye | 99% |

| coking coal | China | 53% | Poland | 26% |

| cerium 1 | China | 85% | China | 85% |

| cobalt | Democratic Republic of the Congo | 63% | N/A | N/A |

| dysprosium 2 | China | 100% | China | 100% |

| helium | United States of America | 56% | Qatar | 35% |

| erbium 2 | China | 100% | China | 100% |

| europium 2 | China | 100% | China | 100% |

| feldspar | Türkiye | 32% | Türkiye | 51% |

| fluorite | China | 56% | Mexico | 33% |

| phosphorite | China | 48% | Morocco | 27% |

| phosphorus | China | 74% | Kazakhstan | 65% |

| gadolinium 2 | China | 100% | China | 100% |

| gallium | China | 94% | China | 71% |

| germanium | China | 83% | China | 45% |

| natural graphite | China | 67% | China | 40% |

| iridium 3 | South Africa | 93% | N/A | N/A |

| ytterbium 2 | China | 100% | China | 100% |

| yttrium 2 | China | 100% | China | 100% |

| lanthanum 1 | China | 85% | China | 85% |

| lithium | Australia | 53% | Chile | 79% |

| lutetium 2 | China | 100% | China | 100% |

| magnesium | China | 91% | China | 97% |

| manganese | South Africa | 29% | South Africa | 41% |

| neodymium 1 | China | 85% | China | 85% |

| nickel | China | 33% | Finland | 38% |

| niobium | Brazil | 92% | Brazil | 92% |

| holmium 2 | China | 100% | China | 100% |

| palladium 3 | Russia | 40% | N/A | N/A |

| platinum 3 | South Africa | 71% | N/A | N/A |

| praseodymium 1 | China | 85% | China | 85% |

| copper | Chile | 28% | Poland | 19% |

| rhodium 3 | South Africa | 81% | N/A | N/A |

| ruthenium 3 | South Africa | 94% | N/A | N/A |

| samarium 1 | China | 85% | China | 85% |

| scandium | China | 67% | China | 67% |

| silicon | China | 76% | Norway | 35% |

| strontium | Spain | 31% | Spain | 99% |

| tantalum | Democratic Republic of the Congo | 35% | Democratic Republic of the Congo | 35% |

| terbium 2 | China | 100% | China | 100% |

| titanium | China | 43% | Kazakhstan | 36% |

| thulium 2 | China | 100% | China | 100% |

| tungsten | China | 86% | China | 32% |

| vanadium | China | 62% | China | 62% |

1 group light rare earths

2 group heavy rare earths

3 platinum group metals

Tag

menu