Previews for 2024 of business intelligence on energy and raw materials

energymagazine

Growth, global trade, energy and commodity prices, redemption, monetary policy, electric car. The 10 forecasts for 2024 from CRU, the business intelligence on the metals, mining and fertilizers industries.

The 10 CRU predictions for 2024:

1. United States and China slow down, global growth will stop at 2%

The global economy proved unexpectedly resilient in 2023. Growth was below the trend rate of around 3%, but only moderately (2.5% according to CRU). This is largely thanks to the United States, which avoided recession (+2.4% in 2023), but which will slow down in 2024 due to restrictive monetary policy. China will also slow down further. Europe will experience a limited recovery, but not enough to prevent a slowdown in global growth from 2.5% to 2.0% in 2024. From 2025 onwards, growth is expected to return close to trend.

2. Growth will be richer in raw materials, accelerate industrial production

Consumer spending and construction will be key. While 2023 saw resilient GDP growth, it was not commodity-centric. In 2024, growth will be much more favorable to the demand for raw materials. The demand for goods regains its position compared to that of services, stimulating industrial production in many East Asian countries highly exposed to consumer electronics.

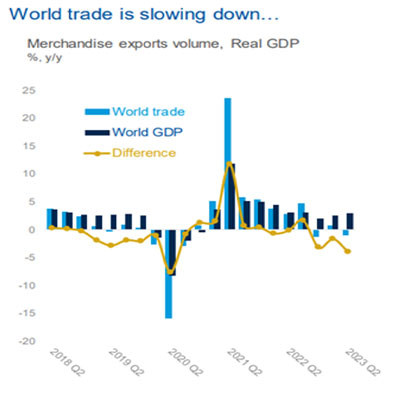

3. Global trade will not keep pace with economic growth, protectionism remains a threat

Global trade is under pressure due to rising tensions. After the strong recovery in 2021, global trade flows stabilized briefly in early 2022 and are now slowing. Quarterly data in terms of trade volume have declined twice year-on-year since 2022, while the gap between world trade and real GDP growth has widened from 0.5 percentage points in the first half of 2022 to 2.9 percentage points in the first half of 2023. In 2024, the economy will continue to outpace trade. Protectionism remains a key threat to global trade. The war in Ukraine has triggered protectionist measures at all levels, and the recent conflict in the Middle East could trigger similar repercussions. But the slowdown in global trade has been underway for some time.

4. Geopolitics remains the main driver of energy prices

Geopolitical tensions continue to impact oil and gas markets. For 2024, CRU forecasts that the price of Brent crude oil should average $86 per barrel. Russian oil production will be stable at 10.6 Mbbl/d, mainly serving India and China. The war between Israel and Hamas will have a limited impact on oil flows, with Iran supporting its exports to China. Gas prices will remain elevated, above $15/MMBtu, due to reduced Russian supplies and delayed LNG expansion. Deliveries of Russian gas to Europe will average 22 billion cubic meters.

5. Inflation will continue to fall in the United States and the Eurozone

Inflation will continue its downward trend in the United States and the Eurozone. The latest data shows US inflation at 3.2% y/y in October and Eurozone inflation at 2.4% in November. Inflation will continue to fall in 2024, albeit at a slower pace. While in the Eurozone inflation was driven by the energy crisis and rising food prices, in the United States it was driven more by an imbalance between supply and demand for goods and labor, which led to rising prices and wages. While the effects of rising energy and food prices are gradually fading, the U.S. job market is still tight. However, the expected slowdown in the United States should still be enough to bring inflation to 2.3% in the fourth quarter and allow the Fed to cut interest rates in the first half of 2024.

6. The Fed and ECB will begin cutting rates in the first half of 2024

Lower inflation and weaker growth will create room for looser policy. Inflation will continue to fall although it remains above target in both the United States and the Eurozone. The combination of falling inflation and weak growth will lead both central banks to start a rate cutting cycle in the first half of 2024. With slightly lower inflation and a weaker economy, the ECB will start cutting in April by reducing rates by 150 basis points by the end of 2024. The Fed will make its first cut in May, reducing rates by 100 basis points in total by the end of 2024. Persistent cost pressures from deglobalization and the energy transition will also result in higher rates globally. Tighter fiscal policy and weaker growth fundamentals will keep Eurozone rates below US rates.

7. China will avoid deflation

Fluctuations in food prices play a key role in China's consumer price index, which has hovered around 0% for the past six months. PPI inflation has been negative over the past year. This has led many analysts to fear that China is about to slide into a long deflationary episode comparable to that which occurred in Japan starting in the early 1990s. Although China faces significant challenges, CRU considers these fears overblown and expects inflation to return to positive territory in 2024.

8. Construction sectors in major economies will stabilize, but will not recover

Tighter monetary policy has hit real estate markets in Europe hard. Mortgage rates are rising and mortgage lending is slowing. House prices fell by almost 10% y/y in Germany in nominal terms in the second quarter and by more than 16% y/y in real terms. There has been some compensation from public investment, but with fiscal policy set to tighten this cannot be counted on. The recovery in private demand should lead to a stabilization of the construction sector.

Rising interest rates have also reduced demand for residential real estate in the United States. In China, the multi-year crisis in the real estate sector has continued into 2023. It is unlikely that the sector will ever return to being the growth engine it was in the period following the global financial crisis. However, the policy support put in place will help stabilize construction production in 2024.

9. Global auto production growth will slow, but electric vehicles will gain further market share

Weakening demand will have a greater impact on the production of light vehicles but not on the market share of electric vehicles. Having overcome the chip crisis, the global auto industry has deftly managed several challenges this year: labor disputes in North America, supply chain pressures in Europe and changing market dynamics in China.

Despite these obstacles, most regions experienced strong growth in 2023. In 2024, the combination of modest global growth, consequences of rising interest rates and declining pandemic-era backlogs is expected to slow global light vehicle production (+2.2% y/y). Electric vehicle (EV) sales have shown resilience, remaining stable despite macroeconomic challenges across markets. This trend is expected to persist despite the expected slowdown in LV production growth. The global EV market share will continue its upward momentum, surpassing 16% of global sales in 2024.

10. CRU commodity basket prices will be lower in 2024

A further decline in raw material prices is expected. Commodity prices remained subdued in 2023, with a weaker-than-expected Chinese reopening and weak European demand. Forecasts for 2024 indicate the CRU commodity price basket falling by 5.5% due to the global economic slowdown. The price basket includes 40 forecasts for mining, metals, energy and fertilizer prices, with prices expected to decline across all subcategories, namely raw materials, metals, precious metals, technology metals and fertilizers. The sharpest price decline is expected for technological metals, including nickel, lithium and cobalt.

Geopolitical conflicts continue to pose the greatest risks to commodity prices. Looking ahead to 2024, prices in most sub-categories will decline relative to the 2022 price level. Among the sub-categories, only precious metals prices are expected to increase in the medium term due to monetary easing and the expected increase in demand.

Tag

menu